Ethereum Gas Fees Explained in Simple Terms

Ethereum has truly shaken up the blockchain world by opening the door for programmable smart contracts and decentralized applications to flourish like never before. That said, gas fees remain a vital and often head-scratching aspect of how it all functions.

What is Ethereum? A Quick Introduction That Might Just Spark Your Curiosity

Ethereum operates as a decentralized blockchain platform that lets developers build and roll out smart contracts and dApps with relative ease. It handles more intricate transactions than Bitcoin does, which mostly sticks to the basics of digital currency.

A Handy Beginner's Guide to Ethereum Gas

On the Ethereum network, gas acts like the fuel that powers every bit of computational work needed to carry out operations. Every action you take on the blockchain burns some gas, which not only helps divvy up resources fairly but also acts as a gatekeeper to keep the network from being overwhelmed or misused.

- Gas is basically the fuel for running operations on Ethereum, representing the computational effort involved.

- It plays a key role in making sure network resources are divvied up fairly and stops anyone from hogging the system or causing trouble.

- How much gas you need really depends on the nitty-gritty details—like how complex your transaction is and the number of instructions it packs.

- Gas is totally separate from Ether, which is the cryptocurrency you actually spend to pay for those gas fees.

What Exactly Are Gas Fees, and Why Do We Even Need Them?

Gas fees are the little tolls users hand over to miners or validators to get their transactions processed and locked in on the Ethereum blockchain. Think of these fees as the motivation juice that keeps everyone in the network plugging away.

- Gas fees give miners and validators a solid economic incentive to pick and include transactions in blocks.

- They play a key role in keeping the network secure by making sure only transactions with decent fees get the green light.

- Gas fees also act as a clever gatekeeper, blocking spam and denial-of-service attacks by discouraging unnecessary or frivolous transactions.

- This fee system does a pretty neat job of balancing the constant tug-of-war between transaction demand and the network’s capacity to handle it.

How Exactly Do Gas Fees Get Calculated?

Gas fees are worked out using a pretty straightforward formula: Gas Fee = Gas Limit × Gas Price. Think of the gas limit as the max gas a user is willing to throw at a transaction, while the gas price is basically how much Ether they are cool with paying per unit of gas.

| Component | Definition | Examples |

|---|---|---|

| Gas Limit | The maximum number of gas units a user is willing to spend, no more no less | A straightforward ETH transfer typically uses about 21,000 units, give or take |

| Gas Price | How much Ether (measured in Gwei) you pay for each unit of gas, like a tiny toll fee | Usually hovers around 30 Gwei, but it can spike above 200 Gwei when things get busy |

| Total Fee | Simply the Gas Limit times the Gas Price, boiled down to Ether | So, 21,000 multiplied by 30 Gwei works out to about 0.00063 ETH – not too shabby for a quick transfer |

Gas price is measured in Gwei, a tiny fraction of Ether—think of it as cents to a dollar—where 1 Ether equals 1 billion Gwei. The gas price tends to ebb and flow depending on how crowded the network gets. When things get busy, people might pay more than 200 Gwei to hurry their transactions. During quieter moments, prices can dip below 10 Gwei.

Getting to Grips with the Gas Limit

The gas limit is basically the ceiling on how much gas a user is willing to shell out to get a transaction done.

- Sending a basic ETH transfer usually calls for a gas limit around 21,000 units—pretty much the standard fare.

- When you dive into more complex smart contracts expect a much heftier gas limit that can reach hundreds of thousands.

- Set the gas limit too low and you are asking for trouble: the transaction will flop and you will burn gas for nothing. Go too high and you might feel like you are throwing money away. Luckily any unused gas usually returns to your wallet.

Gas Prices and Network Demand Driving the Surge

Gas prices aren’t carved in stone and tend to ebb and flow with demand on the Ethereum network. When transaction activity heats up, the scramble for block space kicks into high gear and nudges gas prices upwards as users sweeten the deal with bigger fees to get their transactions processed quickly.

The Ethereum London Upgrade rolled out EIP-1559 and changed the fee market by introducing a base fee that adjusts with each block based on network congestion plus optional tips miners can grab.

Understanding EIP-1559 and the Updated Fee Structure—A Closer Look

Under EIP-1559, the gas fee is made up of a base fee that gets burned and a priority tip handed over to miners as a little nudge to process the transaction.

- The base fee is a dynamically adjusted amount required to get a transaction included and it gets burned, which reduces the total Ether supply—a neat way to keep things in check.

- The priority tip is optional and acts as a nudge to miners to process transactions faster when you are in a hurry.

- Users set a max fee they are comfortable paying that covers both the base fee and the tip, like setting a spending limit before you start shopping.

- This system makes fees more predictable and helps beef up network security, which is always a win in my book.

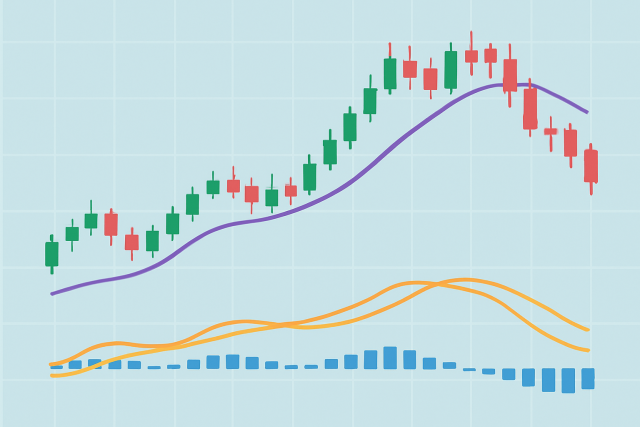

Visual representation of the EIP-1559 fee mechanics including base fee, tip, and total cost.

What Makes Ethereum Gas Fees Fluctuate?

Gas fees on Ethereum tend to bounce around quite a bit because of factors like transaction volume ramping up and network congestion creeping in. Block size limits act as a bottleneck. The nitty-gritty of running smart contracts and the ever-shifting market conditions also play a role.

- Fees tend to shoot up pretty quickly when demand spikes, especially around the launch of popular tokens—kind of like rush hour traffic but for transactions.

- When DeFi protocols and NFT marketplaces get super busy all of a sudden, it often clogs the network and drives fees higher than usual.

- Network upgrades or unexpected downtime can slow things down temporarily, nudging fees upward as people wait in line.

- Shifts in the wider economy or crypto markets usually play a big role in how much people are willing to fork over for gas fees.

How Gas Fees Really Impact Ethereum Users Day to Day

Gas fees hit users in many ways. Casual users tend to shy away from low-value transactions because the costs can quickly add up. DeFi traders constantly juggle the delicate dance between speed and expense. Meanwhile, dApp developers work hard to squeeze every bit of efficiency from their smart contracts. NFT collectors usually map out their purchases carefully to dodge fees.

High gas fees often put the brakes on Ethereum’s scalability, as individuals usually steer clear of small transactions or interactions when the cost feels a bit steep.

Tips for Estimating and Managing Gas Fees Like a Pro Without Losing Your Mind

Handle gas fees effectively by keeping a close eye on current prices using reliable gas tracker tools and setting appropriate gas limits based on the type of transaction.

- Keep an eye on real-time gas trackers every now and then to get a good feel for current fee rates, since they can change faster than you think.

- Try to schedule non-urgent transactions during times when the network is less crowded. It’s a neat little trick to save some fees.

- Opt for wallets that come with handy built-in fee estimation and optimization tools because it’s like having a smart assistant in your pocket.

- Weigh up whether paying a bit more for faster transactions is worth it or if you’re happy to wait a bit and keep costs low. Sometimes patience really is a virtue.

Options and Strategies for Tackling Those Pesky High Gas Fees

There are quite a few promising approaches brewing to tackle Ethereum's notorious gas fee headaches. Layer 2 scaling solutions and sidechains along with the much-anticipated Ethereum 2.0 updates all aim to boost throughput and trim costs.

- Rollups including Optimistic and Zero-Knowledge (ZK) rollups cleverly bundle transactions off-chain to help scale the network.

- Sidechains like Polygon act as handy alternate routes with lower transaction fees and work well with Ethereum.

- Ethereum 2.0’s sharding splits the network into smaller pieces and should increase its overall capacity.

- The introduction of EIP-1559 smooths out pesky fee swings and keeps the supply in check making things more predictable.

- Other blockchains try different approaches but often sacrifice some decentralization along the way.

Common Misunderstandings and Myths About Ethereum Gas Fees Let’s Clear the Air

People often get the wrong end of the stick when it comes to understanding how Ethereum gas fees work. Some people assume the fees go straight into developers’ pockets. Others think the cost is set in stone. Then there are those who wait it out hoping the fees will magically vanish.

Many users often assume gas fees are set in stone or that they magically end up in the pockets of Ethereum developers. In reality, these fees ebb and flow with the network’s busy-ness and are primarily meant to reward the validators—the individuals who keep the blockchain safe and sound.

Future Outlook for Ethereum Gas Fees

Upcoming protocol upgrades paired with the broader adoption of layer 2 scaling solutions and the full rollout of Ethereum 2.0 are expected to bring gas fees down quite a bit.

As Ethereum forges ahead it walks a fine line—juggling the need to stay decentralized, scale up to handle millions of users and keep transaction costs from spiraling out of control. Fresh developments like understanding ethereum's evolving fee structures and new takes on scalability look promising to strike this balance. If all goes well these innovations might make Ethereum more user-friendly and accessible to the masses without throwing its core principles under the bus.